Alice's Email Insights

Exploring the world of email communication and technology.

BTC: The Rollercoaster Ride of Your Crypto Dreams

Experience the wild ride of Bitcoin! Discover trends, tips, and tales that make BTC your ultimate crypto thrill. Don't miss out!

Understanding Bitcoin Volatility: What Drives the Rollercoaster Ride?

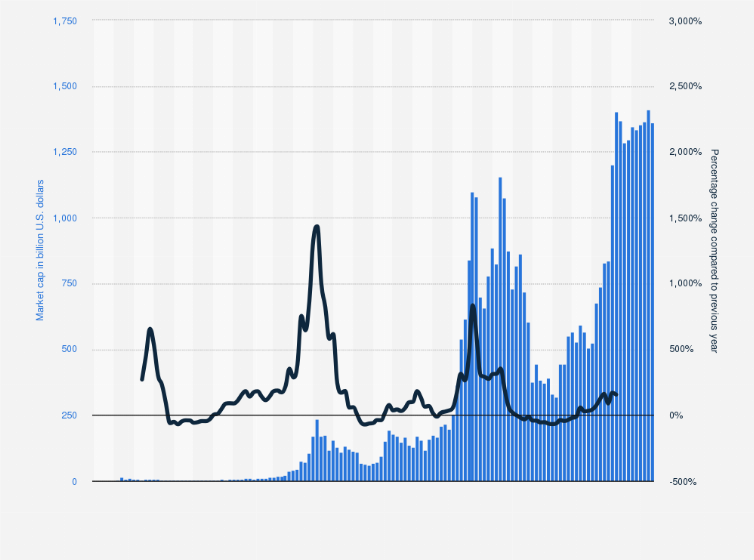

Bitcoin, the pioneering cryptocurrency, is notorious for its volatility. Understanding what drives this rollercoaster ride requires examining various factors. Firstly, market sentiment plays a crucial role; news events, regulatory announcements, and global economic trends can drastically influence investor behavior. When the sentiment is optimistic, prices may soar rapidly, whereas negative news can trigger widespread panic selling, resulting in sharp declines. Additionally, liquidity issues in the relatively young and evolving Bitcoin market can exacerbate these fluctuations, leading to significant price swings over short periods.

Another critical element driving Bitcoin's volatility is its supply and demand dynamics. The total supply of Bitcoin is capped at 21 million coins, which creates a unique scarcity. As more people adopt and invest in Bitcoin, demand can outpace supply, pushing prices skyward. Conversely, when interest wanes or investors take profits, the price can plummet. Moreover, factors like technical trading and speculative behavior often amplify these movements, as traders react to price charts and trends, further contributing to Bitcoin's unpredictable nature.

Top 5 Tips for Navigating the Bitcoin Market's Ups and Downs

Navigating the Bitcoin market can often feel like riding a roller coaster, with its frequent fluctuations and unpredictable trends. To enhance your trading experience and maximize profits, consider these Top 5 Tips for successfully managing the ups and downs of Bitcoin:

- Stay Informed: Regularly follow news related to Bitcoin and the broader cryptocurrency market. Understanding the factors that influence price movements can help you make informed decisions.

- Develop a Strategy: Before diving into trading, outline a clear strategy that incorporates both short-term and long-term goals. This will keep your trading disciplined and focused.

Additionally, it is critical to practice risk management. Set stop-loss orders to minimize potential losses and avoid over-investing in a single asset. Diversifying your investments can provide a buffer against market volatility. Lastly, take the time to reflect on your trading experiences—whether successes or failures—to continuously refine your approach to the Bitcoin market.

- Learn Technical Analysis: Familiarizing yourself with technical indicators can provide insights into market trends and help in predicting possible price movements.

- Engage with the Community: Participate in forums and social media groups focused on Bitcoin trading. Engaging with other traders can enhance your understanding of market dynamics.

Is Investing in Bitcoin Worth the Risk? A Deep Dive into Crypto Dreams

As the world increasingly embraces digital currencies, many investors are left pondering the critical question: Is investing in Bitcoin worth the risk? Bitcoin, the first and most well-known cryptocurrency, has experienced extraordinary fluctuations in value, making it both a source of immense profit and significant loss. Over the years, early adopters have seen their investments multiply exponentially, while others who bought in at the wrong time experienced steep declines. To understand whether investing in Bitcoin aligns with your financial goals, it's essential to evaluate its market volatility, potential for growth, and the evolving regulatory landscape.

While investing in Bitcoin can be enticing, potential investors need to weigh the risks involved. One must consider factors such as market sentiment, technological advancements, and global economic trends. Many experts emphasize the importance of diversification; rather than pouring all your resources into one asset, spreading investments across various vehicles can mitigate risks and enhance overall portfolio performance. Ultimately, whether Bitcoin is a worthwhile investment depends on individual risk tolerance and investment strategy, prompting many to wonder if the dreams of crypto riches are worth the inherent uncertainties.