Alice's Email Insights

Exploring the world of email communication and technology.

Term Life Insurance: Your Safety Net or a Budget Drain?

Discover if term life insurance is your financial safety net or just a costly burden. Uncover the truth behind your coverage!

Term Life Insurance: Essential Coverage or Unnecessary Expense?

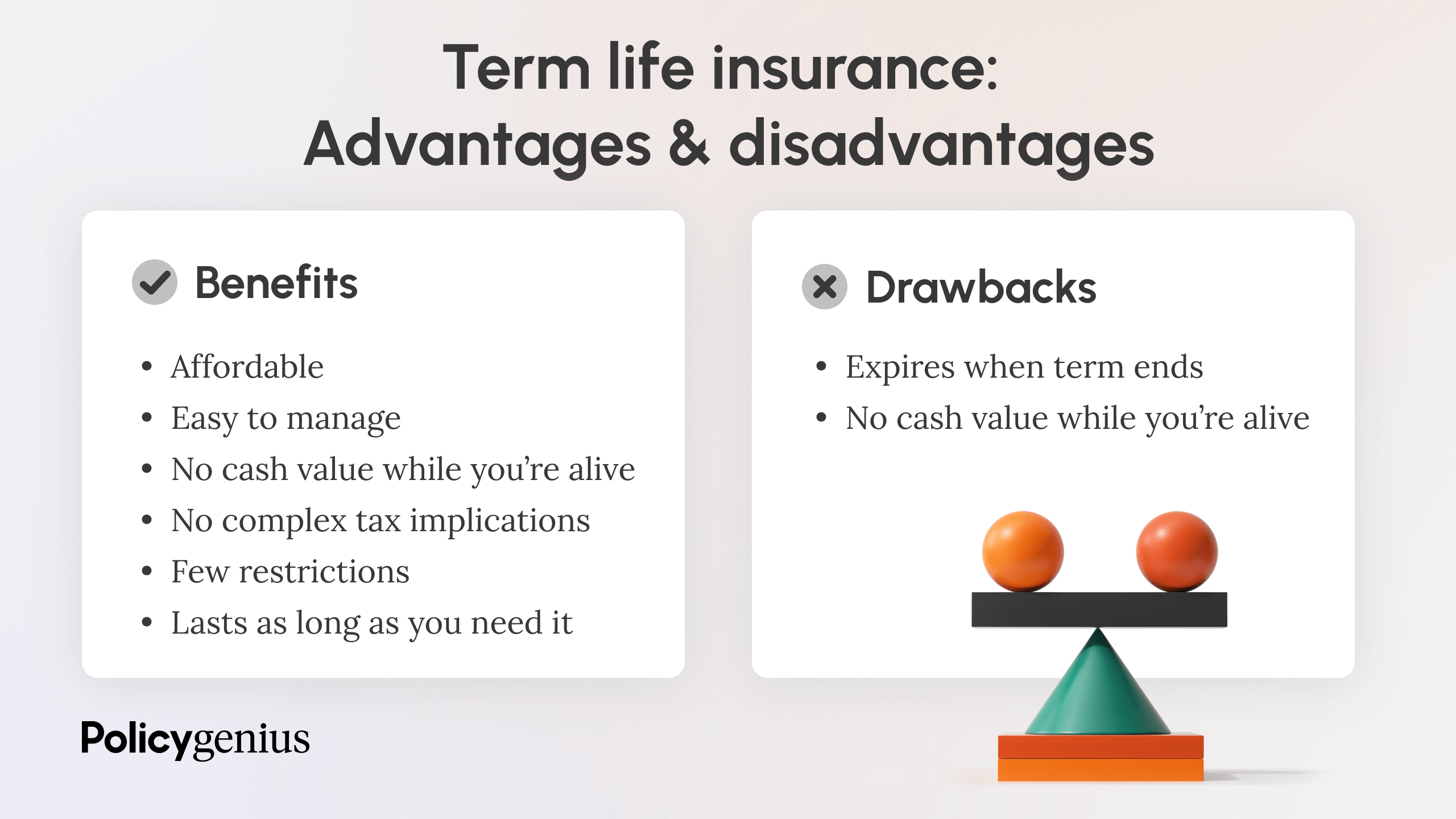

Term life insurance is often viewed through the lens of essential coverage versus unnecessary expense. For many individuals, especially those with dependents, term life insurance provides a safety net that ensures financial security in the event of an untimely death. This form of coverage is typically more affordable than whole life insurance, allowing policyholders to invest in higher coverage amounts during crucial life stages, such as raising children or paying off a mortgage. In this context, the premiums paid may feel like a small price to pay for the peace of mind knowing that loved ones will be financially protected.

However, some view term life insurance as an unnecessary expense, especially for those without dependents or significant financial obligations. Critics argue that by investing in term insurance, individuals may miss out on opportunities to build wealth through other financial vehicles. Moreover, since term policies are temporary and do not accumulate cash value, many consider them less beneficial in the long run. Ultimately, the decision to purchase term life insurance should be guided by personal circumstances, financial goals, and a thorough understanding of one's coverage needs.

Understanding the Costs: Is Term Life Insurance Worth It?

When considering whether term life insurance is worth it, it's crucial to evaluate both the costs involved and the potential benefits it provides. Term life insurance is typically more affordable than permanent policies, making it an attractive option for many individuals. The premiums are based on various factors including age, health, and the term length chosen. This cost-effectiveness allows policyholders to secure substantial coverage without breaking the bank, which can be especially beneficial for young families looking to protect their loved ones financially in case of an unforeseen event. However, it’s essential to remember that term life insurance only lasts for a specified period, usually 10 to 30 years, and does not accumulate cash value over time.

Weighing the costs against the potential security offered by term life insurance is vital in making an informed decision. For many, the peace of mind that comes from knowing their beneficiaries will receive a death benefit can outweigh the financial commitment of monthly premiums. Consider the following factors when determining if it's worth the investment:

- Your financial obligations: How much would your loved ones need to maintain their quality of life?

- Existing savings and assets: Do you have sufficient resources to cover debts and future expenses?

- Dependents: How many people rely on your income?

How to Assess if Term Life Insurance Fits Your Financial Plan

When considering term life insurance as part of your financial plan, it's essential to assess your current and future financial obligations. Start by evaluating your dependents' needs, such as monthly expenses, debts, and education costs. Create a list of these obligations and calculate an adequate coverage amount that would provide financial security for your loved ones in your absence.

Next, consider your budget and how term life insurance fits into it. Review your existing expenses and savings priorities to determine how much premium you can afford. Use this information to compare various policies, ensuring you choose one that aligns with your financial goals without straining your monthly budget. Remember that planning ahead not only provides peace of mind but also strengthens your overall financial strategy.