Alice's Email Insights

Exploring the world of email communication and technology.

Term Life Insurance: Your Safety Net in Disguise

Discover how term life insurance can be your ultimate safety net in disguise—protect your loved ones without breaking the bank!

Understanding the Basics of Term Life Insurance: What You Need to Know

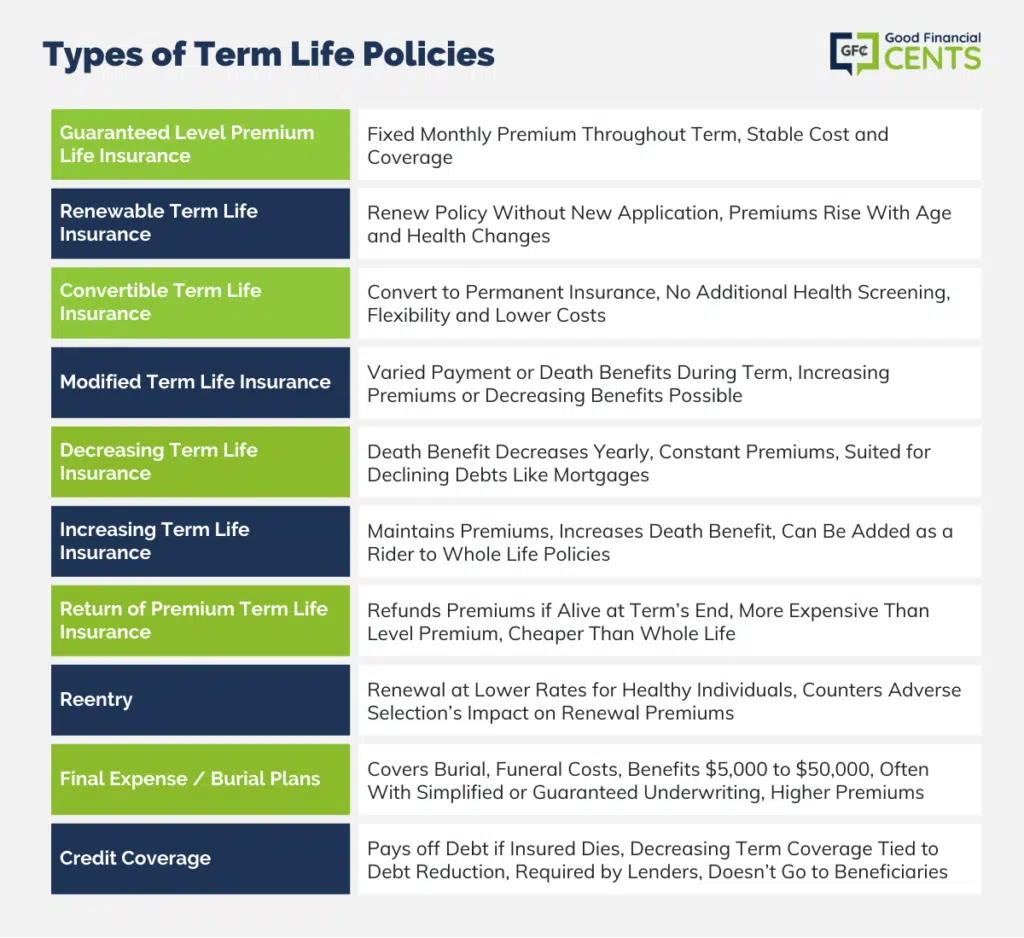

Term life insurance is a type of life insurance policy that offers coverage for a specified period, typically ranging from 10 to 30 years. It is designed to provide a death benefit to your beneficiaries in the event of your passing within that term. Unlike permanent life insurance, term life policies do not build cash value and are generally more affordable, making them an attractive option for those looking to secure their family's financial future without the higher premiums associated with whole life insurance. For more detailed information about the differences between term and whole life insurance, check out Investopedia.

When selecting a term life insurance policy, it’s essential to consider several factors including the amount of coverage you need, your budget, and the length of the term that best suits your financial obligations. Many consumers opt for coverage that can last until their children are financially independent or until their mortgage is paid off. Additionally, most policies offer the option to convert to a permanent policy later on, providing flexibility to adapt to your changing financial situation. For tips on how to choose the right policy, visit NerdWallet.

Is Term Life Insurance Right for You? Key Questions to Consider

When considering term life insurance, it's essential to evaluate your personal circumstances and financial goals. Some key questions to ask yourself include: What is the purpose of life insurance? Are you looking to provide financial security for your family in case of an untimely death? Understanding your objectives will help you determine whether term life insurance is suitable for your needs. Additionally, how long do you need coverage? Term life insurance is typically offered in set periods, such as 10, 20, or 30 years. If you need coverage only for a specific time frame, term insurance could be a great option. For more insights on life insurance, you can visit NerdWallet.

Moreover, consider your financial situation and future obligations when deciding on term life insurance. Ask yourself: How much coverage do I need? A common guideline is to multiply your annual income by a factor of ten to fifteen, but your specific obligations such as mortgage payments, education costs for children, or outstanding debts should also be factored in. Lastly, what is your budget for premiums? Ensure you can comfortably afford the monthly or annual payments without straining your finances. Assessing these aspects will help you make an informed decision. For further guidance, check out Forbes.

The Hidden Benefits of Term Life Insurance: More Than Just a Safety Net

Term life insurance is often perceived solely as a financial safety net for dependents in the event of an untimely demise. However, its advantages extend far beyond that basic function. For many policyholders, term life insurance can serve as a flexible financial tool, allowing them to secure peace of mind during critical life stages. This type of policy is generally more affordable than permanent life insurance, enabling individuals to allocate their funds towards other investments or savings plans while still having a layer of protection for their loved ones.

Additionally, some term life insurance policies come with the option to convert to a permanent policy, allowing flexibility in changing financial circumstances. This feature can provide long-term security without needing a new medical exam or going through the application process again. Furthermore, the death benefit can also play a significant role in covering things like major life expenses, such as mortgage loans or children's education, giving policyholders an extra layer of financial support during life's unpredictability.